Insights Into Salesforce’s Shifting Product Strategy

- August 28, 2023

- Salesforce and Pardot, Salesforce Ben | The Drip

After following a consistent product strategy for many years, Salesforce’s approach to its product portfolio has pivoted regularly due to the global pandemic and rapidly changing customer demands.

It can be easy to get lost in the noise of forward-looking announcements and the renaming of products, so let’s take a closer look at what’s going on at this San Francisco giant.

The Early Days

If you read our piece on Role Specialisation (LINK), you may recall a section that discussed how Salesforce initially approached their product portfolio. Essentially, they focused on core areas of capability (Sales, Service, Marketing) with well-defined boundaries around the goals of each product.

To address the many gaps that existed, Salesforce launched the AppExchange, which allowed third-party vendors to bring their own solutions to the market. The initial vanguard was made up of both familiar and unfamiliar names, including Apptus (Configure Price Quote), NewVoiceMedia (Telephony), FinancialForce (Billing), and SKUID (Graphical UI design), which all initially carved out a niche.

The Grand Expansion

These gaps in the Salesforce capability landscape were very profitable; dominant independent vendors appeared and certain verticals became incredibly competitive with everybody looking for a slice of the SAAS monthly income. This was obviously not lost on Salesforce, who quickly moved to join together the disparate parts of their own ecosystem.

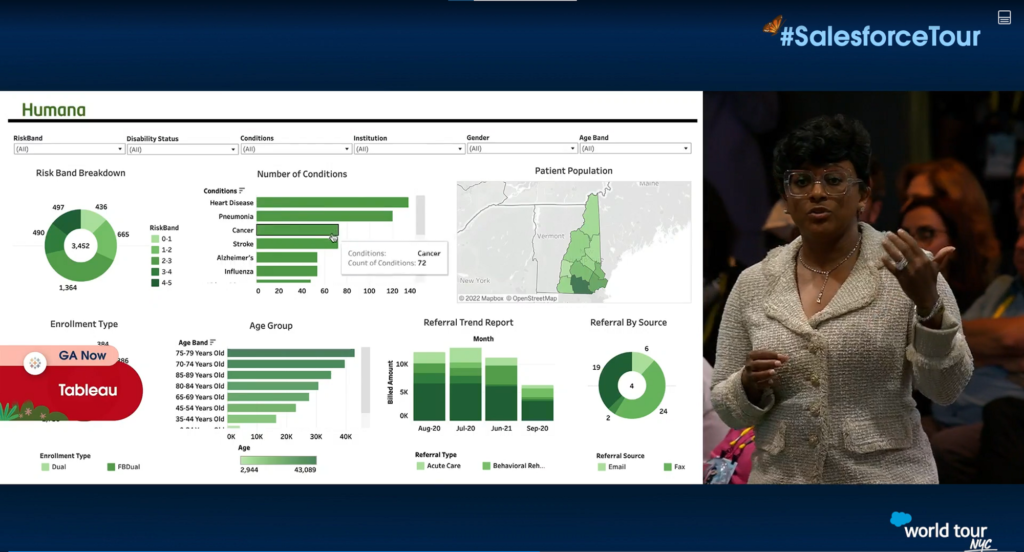

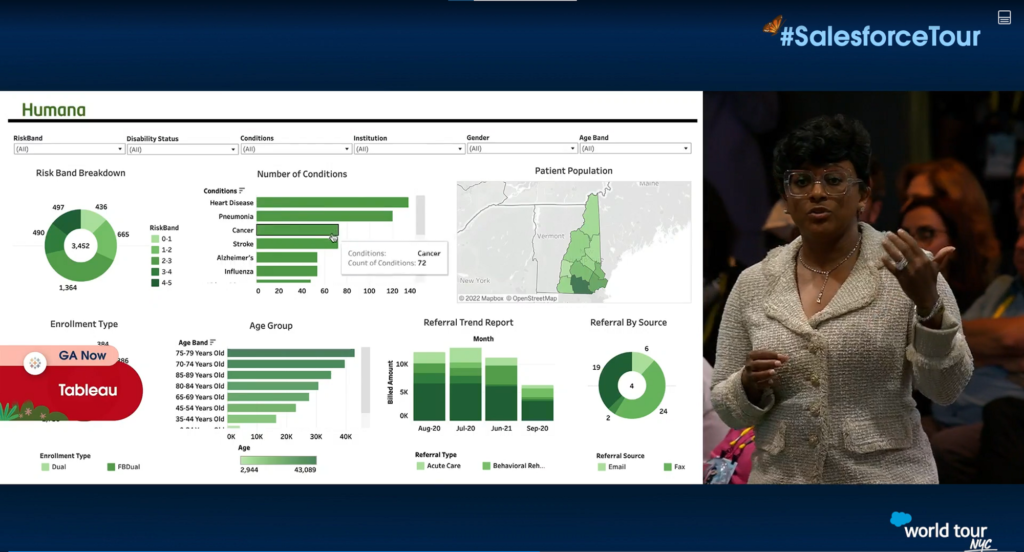

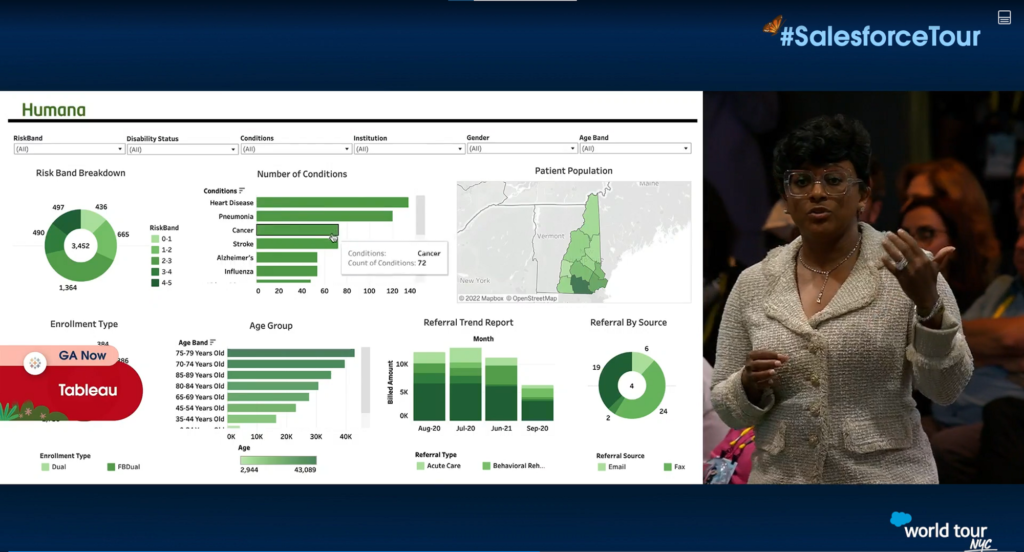

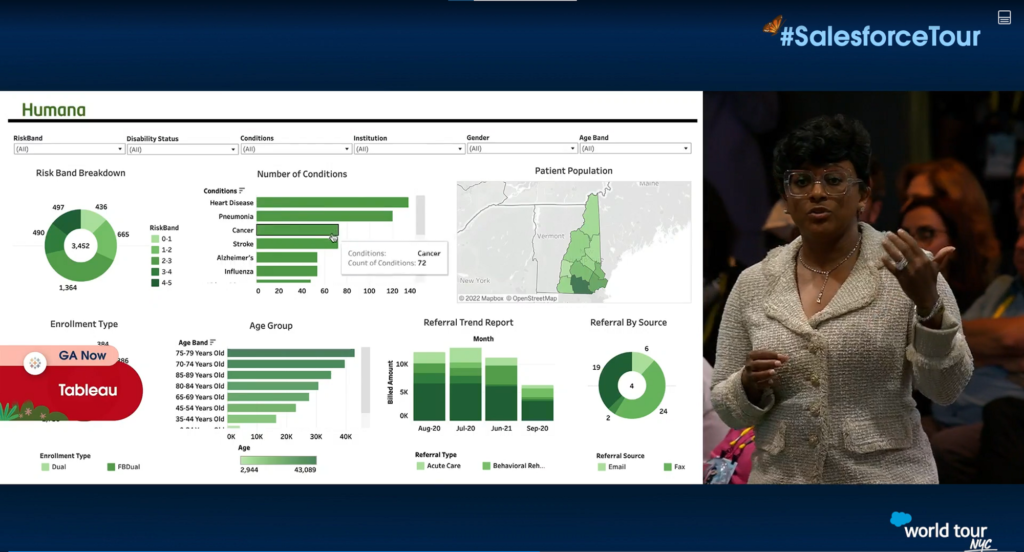

As subtle as it was, this integration was most visible at their Dreamforce and World Tour events. During keynote presentations, the Customer360 circle began to appear in customer case stories, with different elements of the platform being highlighted to illustrate which part (or combination of parts) of Salesforce was pulling the strings in order to realize The Art of the Possible being played out on stage.

To connect the customer journey from marketing awareness to the first point of service, silos had to be broken down.

Key acquisitions (such as Steelbrick for CPQ, MuleSoft for platform integration, and Tableau for enterprise analytics) were complemented by internal R&D through products like Service Cloud Voice for telephony, Salesforce Billing to serve as the endpoint of CPQ, and baked-in analytics from Wave Analytics and Einstein AI. These developments made a compelling argument for keeping your platform strategy within the Salesforce ecosystem rather than looking externally.

While this was likely demoralizing for market leaders in those areas of capability, the acceleration of the Salesforce platform’s capabilities around this time was exhilarating.

Refocusing for Small Threats

It seems that the ride may have been too exhilarating for Salesforce. The global pandemic led to a flurry of activity, including product launches such as Work.com (a rebooting of the employee productivity tool to pivot into pandemic workforce management), as well as the trendy Blockchain and NFT Cloud.

There were also product renaming efforts, with Wave Analytics undergoing yet another name change to become CRM Analytics, and Pardot being rebranded as Account Engagement under the Marketing Cloud portfolio. Additionally, existing product sets were reimagined in new forms, such as CPQ and Billing becoming Revenue Cloud, and Salesforce features being combined with Marketing Cloud to create Loyalty Management. Finally, there were some major acquisitions, with Slack being the most prominent.

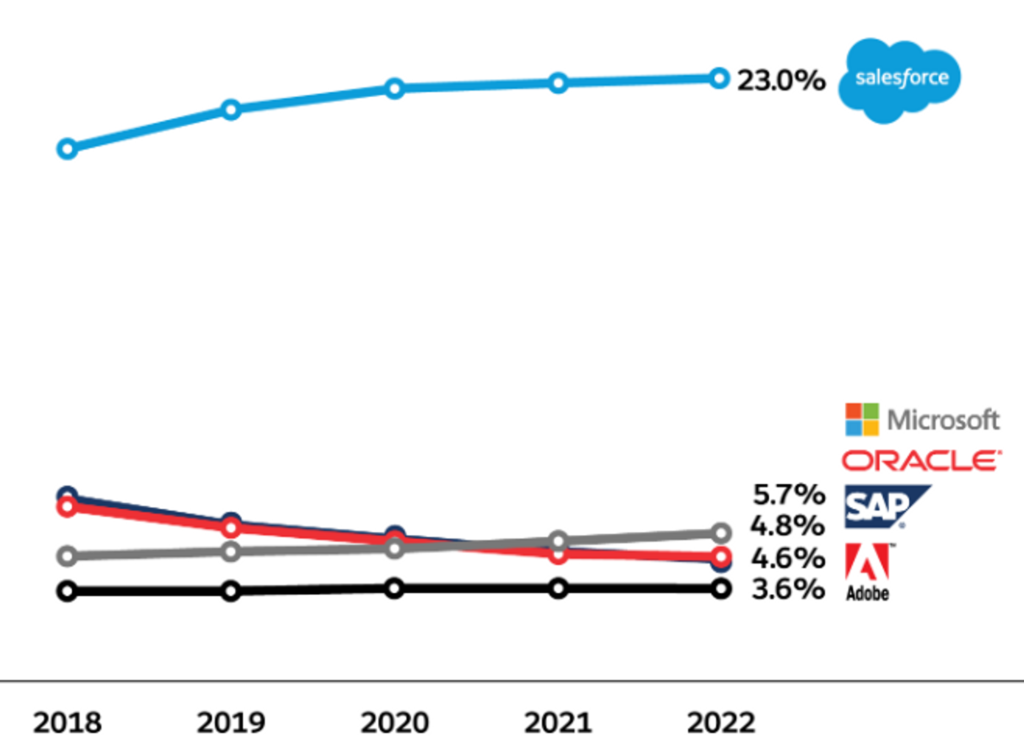

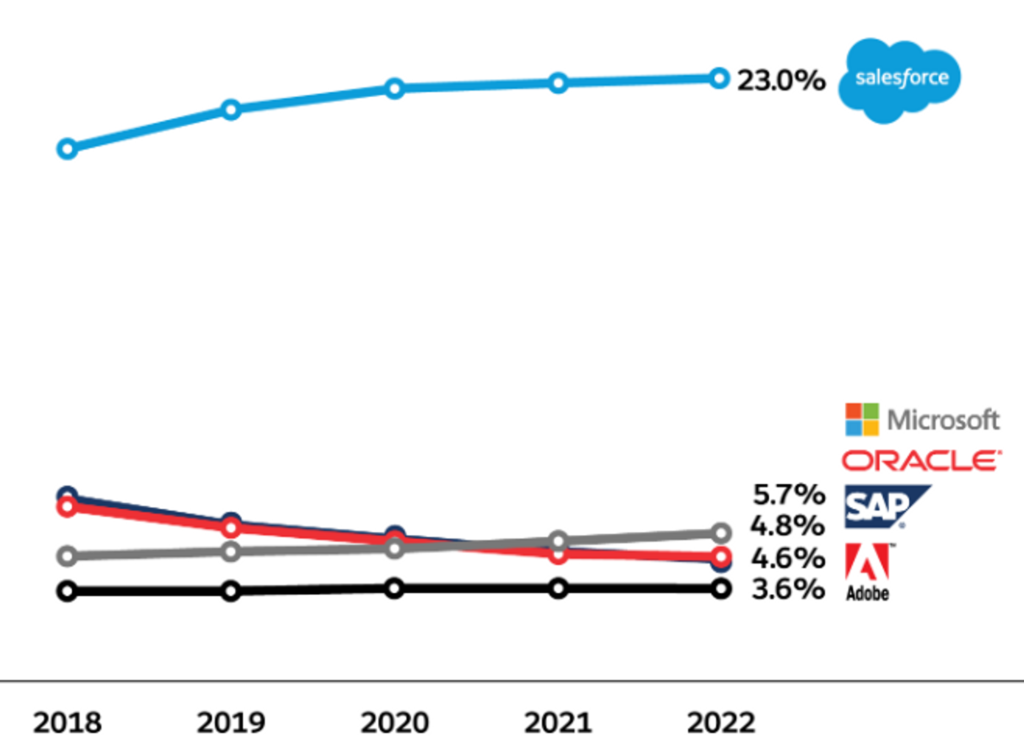

On the surface, Salesforce is still as successful as ever, with almost a quarter of the CRM market share in their favor. However, recent activity suggests that they are taking steps to mitigate risks that have started to make themselves known. Stock market prices have been dropping for Salesforce, which has led to the rise of activist investors taking a much more active role in the direction of Salesforce, nudging the course of the usually free and independent Marc Benioff. However, since Salesforce have focussed on profitability over the course of this year, those activist investors have backed off.

Redundancy

The pandemic fueled incredible expansion at Salesforce, but it also resulted in ferocious headcount growth. Unfortunately, this year, thousands of employees anxiously awaited monthly announcements to find out if they were still employed.

Less visible has been a trimming of the company’s product offering. Salesforce deemed its broad horizontal product range too wide, leading to the quiet shuttering of products like Social Studio, Workforce Engagement, Marketing Cloud Audience Builder, Meeting Studio, and Elevate.

While this doesn’t signify a return to the Salesforce product silos of the early days, it does indicate a preference for niche specialists to fill the smaller gaps in functionality. Sprout Social and Calibrio Workforce Management are two vendors particularly well positioned to benefit from this shift.

The Other 60%

While the gap between Salesforce and other big hitters like SAP, Microsoft, Adobe, and Oracle continues to be as wide as ever, the gains are starting to plateau. There is an array of fresh threats from disruptive specialists, one example being healthcare CRM, Veeva. They recently made a move to spin away from reliance on the Salesforce platform and launch their VaultCRM platform, which has proven to be an enticing ready-to-use package for the industry.

Salesforce has obviously taken vertical threats seriously and adapted their product range to provide several vertical offerings, such as Financial Services Cloud and Health Cloud, as opposed to a generic horizontal. In addition, Vlocity was acquired and folded into Salesforce Industries to create a compelling out-of-the-box offer for industry verticals like manufacturing, media, and communications.

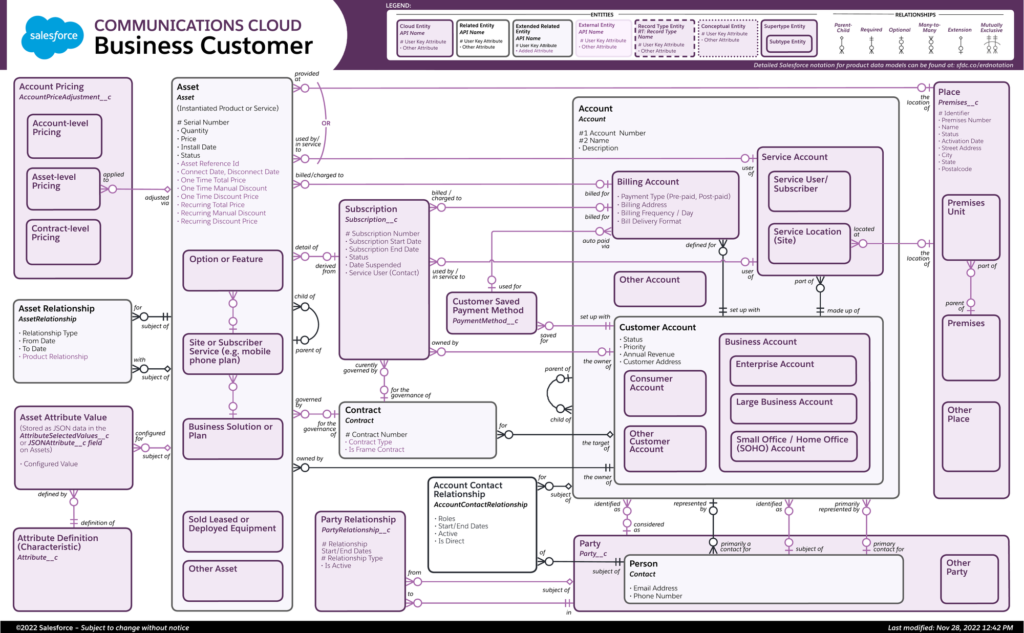

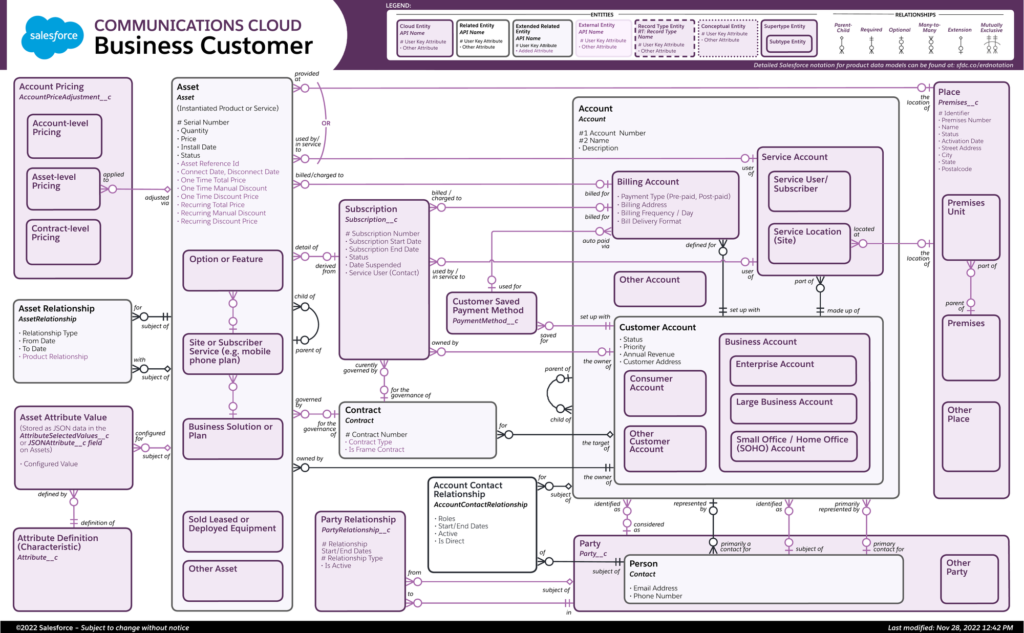

However, Vlocity is still on its journey in terms of being integrated into the core Salesforce platform. While rebranded as Salesforce Industries, its Vlocity roots are still very evident with a lot of manual installation and upgrading, plus several aspects of functionality that are far from the simple point-and-click Lightning Design System. In essence, it still feels like a bolt on rather than pure Salesforce. Its main challenge versus these up-and-coming, nimble, and precise competitors is that it is very expensive and incredibly complex once you look under the hood.

A brief glimpse at the object model, available on the Salesforce Architect portal, illustrates the web of objects and relationships that any prospective customer will suddenly find themselves in charge of. As of now, it is in an awkward place that seems quite far from the straightforward button-click development of the regular Salesforce platform.

Those Licenses Add Up

As mentioned before, cost is a common issue with Salesforce. Once inside your CRM, you’ll find numerous locked doors and areas for growth, all of which come with a considerable price tag. Having a clear delivery roadmap and strategy can provide focus and direction for future spending.

With market share plateauing, upsell opportunities become more important than growth. Organizations that rely on core licenses and make tentative steps into the add-on world are not satisfactory for Salesforce, which has responded by creating the Super SKU.

In essence, these licenses piece together complementary products from within the Salesforce portfolio and sell them as a single license. Here are a few examples: Communications Cloud combines Sales and Service Cloud with the previous Vlocity capability and includes 70K monthly logins for Experience Cloud. Contact Centre pairs Service Cloud with Service Cloud Voice, Surveys, and Digital Engagement. Finally, there is the most recent AI Cloud, which combines the essential generative AI components: Data Cloud, GPT, MuleSoft, Sales & Service Cloud, Slack, and Tableau.

Summary

The rapid shift in the Salesforce Product Portfolio creates uncertainty. While the reasons for the change are clear, nobody wants to receive the intention to sunset communication from Salesforce and face the closure of an add-on product after investing in it for years. Obviously nothing is shut down suddenly, but course correction for roadmaps is something an agile architect needs to have in the back of their mind.

This experience may be new to many in the Salesforce ecosystem, who have only seen the rapid expansion of capabilities and the occasional decommissioning of a platform like Chatter Desktop. Stability has been a cornerstone of the brand for decades now, with Google being the ‘poster boy’ for product mismanagement.

However, there is no need to be alarmed. Salesforce is in rude health and it is doubtful we’ll see any big alterations to the core functionality. Stay agile and you’ll be like a boat that has maneuvered out to sea to avoid the big waves, happily bobbing in the currents rather than dashing against the rocks!

This Pardot article written by:

Salesforce Ben | The Drip

Lucy Mazalon is the Head Editor & Operations Director at Salesforceben.com, Founder of THE DRIP and Salesforce Marketing Champion 2020.

Original Pardot Article: https://www.salesforceben.com/insights-into-salesforces-shifting-product-strategy/

Find more great Pardot articles at www.salesforceben.com/the-drip/

Pardot Experts Blog

We have categorized all the different Pardot articles by topics.

Pardot Topic Categories

- Account Based Marketing (ABM) (8)

- Business Units (13)

- ChatGPT / AI (3)

- Completion Actions (5)

- Connectors (10)

- Custom Redirects (4)

- Demand Generation (8)

- Dynamic Content (5)

- Einstein Features (11)

- Email Delivery (18)

- Email Open Rates (3)

- Pardot A/B Testing (2)

- Email Mailability (16)

- Do Not Email (1)

- Double Opt-in (2)

- Opt Out / Unsubscribe (14)

- Email Preferences Page (6)

- Engagement Studio (14)

- Industries (1)

- Non Profit (1)

- Landing Pages (10)

- Lead Generation (1)

- Lead Management (12)

- Lead Routing (2)

- Lead Scoring (15)

- Leads (3)

- Marketing Analytics – B2BMA (9)

- Marketing Automation (1)

- Marketing Cloud (2)

- Marketing Cloud Account Engagement (4)

- New Pardot Features (6)

- Opportunities (2)

- Optimization (3)

- Pardot Admin (62)

- Duplicates (1)

- Marketing Ops (1)

- Pardot Alerts (1)

- Pardot API (2)

- Pardot Automations (3)

- Pardot Careers (12)

- Pardot Certifications (4)

- Pardot Consulting (1)

- Pardot Cookies (3)

- Pardot Custom Objects (3)

- Pardot Email Builder (7)

- Pardot Email Templates (9)

- HML (6)

- Pardot Events (16)

- Pardot External Actions (1)

- Pardot External Activities (4)

- Pardot Forms (27)

- Form Handlers (7)

- Pardot Integrations (21)

- Data Cloud (1)

- Slack (1)

- Pardot Lead Grading (5)

- Pardot Lead Source (2)

- Pardot Lightning (1)

- Pardot Migration (1)

- Pardot Nurture / Drip Campaigns (1)

- Pardot Personalization (3)

- Pardot Profiles (1)

- Pardot Releases (19)

- Pardot Sandboxes (2)

- Pardot Segmentation (4)

- Pardot Strategy (7)

- Pardot Sync (2)

- Pardot Sync Errors (1)

- Pardot Tracker Domains (5)

- Pardot Training (3)

- Pardot Vs Other MAPs (4)

- Pardot Website Tracking (2)

- Reporting (22)

- Salesforce and Pardot (29)

- Marketing Data Sharing (2)

- Pardot Users (3)

- Salesforce Automation (4)

- Salesforce Flows (1)

- Salesforce Campaigns (20)

- Salesforce CRM (3)

- Record Types (1)

- Salesforce Engage (3)

- Salesforce Queues (2)

- Security and Privacy (1)

- Tags (3)

- The Authors (483)

- Cheshire Impact (9)

- Greenkey Digital (47)

- Invado Solutions (37)

- Jenna Molby (9)

- Marcloud Consulting (6)

- Nebula Consulting (53)

- Pardot Geeks (38)

- Salesforce Ben | The Drip (235)

- SalesLabX (2)

- Slalom (2)

- Unfettered Marketing (45)

- Uncategorized (1)

- Website Tracking (2)

- Website Search (1)

More Pardot Articles

See all posts

This Pardot article written by:

Salesforce Ben | The Drip

Lucy Mazalon is the Head Editor & Operations Director at Salesforceben.com, Founder of THE DRIP and Salesforce Marketing Champion 2020.

Original Pardot Article: https://www.salesforceben.com/insights-into-salesforces-shifting-product-strategy/

Find more great Pardot articles at www.salesforceben.com/the-drip/